State funding falls short on education – a demand for change

Where does our school get its money from to pay for the Chromebooks our district gives to every single student when they start freshman year, the online textbooks we get for class, the dance studio and the new cafeteria? I was surprised when I found that the majority of funding comes from one thing: property taxes.

However, this reliance on property taxes to fund D128 is not unique to us. Public schools in Illinois receive the majority of their funding from local property taxes, leading to an extremely uneven and unfair funding gap between the public schools within high-income and low-income areas.

Illinois’ reliance on property taxes to fund schools is inherently flawed, perpetuating education inequality. Since the largest determinant of the quality of education students receive is money spent, the problem surrounding the massive impact of property value on school funding must be rectified.

-The Facts-

It takes millions and millions of dollars to fund our district, and in Illinois, local property taxes are what pay for our schools. In the 2018-2019 school year, out of the $85,314,776 of total revenue D128 received, 87.8% of that—$74,904,878—came from local property taxes. As a result, VHHS spent $23,294 per pupil. That is quite the hefty sum. In comparison, the state average for total per-pupil expenditure in the 2018-2019 school year was $13,764.

Our significantly high per-pupil expenditure allows the district to equip students with all of the necessary resources and support necessary for their current and future success. Places such as Downtown Libertyville and Mellody Farms, along with high-income housing within Lake County, are a large part of the reason why D128 is ranked the #2 best school districts in Illinois according to niche.com.

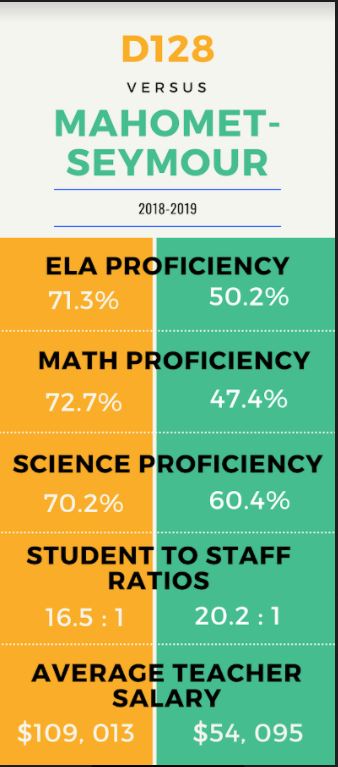

To illustrate just how much of an effect low revenue from property taxes can have on education, about three hours from VHHS, Mahomet-Seymour CUSD 3 faces a completely different situation. Ranked 31st on niche.com, Mahomet-Seymour, consisting of four schools and a total student population of 3,181, does not receive nearly as much revenue as D128. The district receives only $15,357,950 from local property taxes, yet that still makes up 46.2% of their total revenue.

Mahomet-Seymour simply does not receive enough money to fully equip its students. Per-pupil expenditure in the district for 2018-2019 was $9,034, well below the state average. Instead of making up for the revenue gap, the State government only gives Mahomet-Seymour $10,947,164, which is not nearly enough.

The lack of adequate funding for the district has consequences. For example, the average salary for Mahomet-Seymour teachers is $54,095—significantly below the state average. These lower salaries disincentivize prospective teachers and lead to a high staff turnover, as reflected by Mahomet-Seymour’s lower teacher retention rate and percentage of teachers with a master’s degree in comparison to D128.

Beyond that, Mahomet-Seymour and similar districts with low per-pupil expenditures have fewer resources to provide for student learning, along with social and emotional health.

In Illinois, property taxes are determined on a county level. All business and household property values are calculated and are then taxed at a rate, which varies depending on value. The county then collects all of the property tax revenue and distributes it out, largely to school districts.

Thus, the issue Mahomet-Seymour faces is not unique. Illinois relies heavily on local revenue to fund schools, with 66.4% of the average district revenue coming from local funds, as opposed to the national average of 45.6% according to educationdata.org.

The system as it stands now created an ugly cycle in which low-income communities with less business presence and lower-valued housing ultimately receive less funding, subsequently causing those students to not receive the quality of education necessary for economic mobility. It’s extremely difficult for students to be competitors in college applications when their school isn’t given enough money to retain talented teachers, provide students with up-to-date textbooks and create other valuable learning opportunities.

-Fixing the System-

I’m definitely not saying that, for example, part of D128’s revenue from local property taxes should be reallocated to districts like Mahomet-Seymour. Rather, it’s vital that Illinois holistically shifts away from its dependence on tax revenue for funding schools to governmental funding. The state government needs to provide more money to schools with per-pupil expenditures below the state average, committing to ensuring that all public schools in the state have enough money to properly educate students.

This can be achieved through implementing a progressive income tax to increase the budget of the Illinois government, or reapportioning how much money from our current we allocate to education. The fact of the matter is that, as it currently stands, the Illinois government has been neglecting to ensure that all students receive the quality of education necessary for future success.

The first step to true education equality is adequate funding, and it must start with the Illinois government prioritizing the needs of students.